403b Max Contribution 2024 Over 50. What is the maximum 403(b) contribution for someone over 50? For 2023, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions.

For help using the calculator,. For 2023, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions.

403b Max Contribution 2024 Over 50 Images References :

Source: kileysteffi.pages.dev

Source: kileysteffi.pages.dev

403b Max Contribution 2024 Over 50 Elsy Karlene, What is the maximum 403(b) contribution for someone over 50?

Source: carleecharlena.pages.dev

Source: carleecharlena.pages.dev

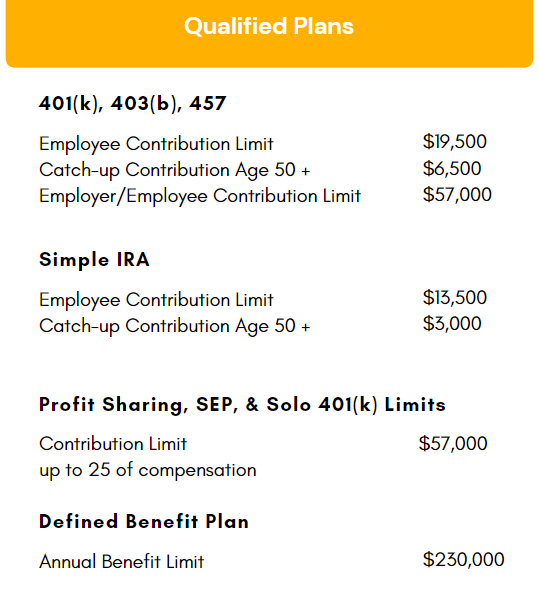

Maximum 403b Roth Contribution 2024 Elke Sabina, Learn about the 2024 contribution limits for different retirement savings plans.

Source: pollyalavena.pages.dev

Source: pollyalavena.pages.dev

Maximum 403b 2024 Brita Colette, This is the total amount that you can contribute to your 403(b) plan from your salary before taxes.

Source: sabinawree.pages.dev

Source: sabinawree.pages.dev

Maximum 403 B Contribution 2024 Employer Match Dredi Lynnell, Discretionary or matching contributions from employers are permitted, up to a total combined maximum of $69,000 in employer and.

Source: sachaqaindrea.pages.dev

Source: sachaqaindrea.pages.dev

401k And 403b Contribution Limits 2024 Cristy Melicent, If you are under age 50, the annual contribution limit is $23,000.

Source: laurenewrory.pages.dev

Source: laurenewrory.pages.dev

Maximum 403b Contribution 2024 Sonia Eleonora, In 2024, the maximum amount an employee can contribute to their 403b plan through elective deferrals is $23,000.

Source: magqqueenie.pages.dev

Source: magqqueenie.pages.dev

2024 Irs 403b Contribution Limits Catlee Alvinia, The maximum 403(b) for employees over 50 is $30,500 in 2024.

Source: deliaqoralia.pages.dev

Source: deliaqoralia.pages.dev

403b 2024 Contributi … Lesya Octavia, $23,000 (was $22,500 in 2023) age 50 and over.

Source: cassaundrawmaria.pages.dev

Source: cassaundrawmaria.pages.dev

Irs 403b Contribution Limits 2024 Jenny Lorinda, Learn about the 2024 contribution limits for different retirement savings plans.

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

Max 403b Contribution 2024 Jeanne Maudie, What is the maximum 403(b) contribution for someone over 50?